Bookkeeping services handle the recording and tracking of any financial transactions that occur in your business. They play an important role in maintaining the financial health of your company.

What do bookkeeping services include? Bookkeeping services typically include:

- Maintaining a chart of accounts

- Providing ledger maintenance

- Reconciling bank accounts

- Creating financial reports

- Overseeing all aspects of accounts payable and receivable

Let’s dive into each of these areas and explore how bookkeeping services can help you gain effective control and understanding of your finances.

What Bookkeeping Services Include

Chart Of Accounts

A bookkeeping specialist will set up your business Chart of Accounts, which is the base of your accounting platform. This organizational tool offers an index for every account in your accounting system.

every account in your accounting system.

A chart of accounts provides insight into all of your company’s financial transactions. Each chart may have its own subcategories, such as operating expenses, revenues, non operating expenses and nonoperating revenues.

This financial structure to your books allows you to get a better sense of your company’s financial health. It should also be designed in a way that allows you to add new accounts and delete old accounts that are no longer relevant.

Ledger Maintenance

Bookkeeping services should provide accurate maintenance of general, expense and assets ledgers for a business. Ledgers are simply financial records of the money your company spends and earns.

Most companies have a general ledger that separates credits from debits. That ledger is then further divided into categories like assets, liabilities and expenses.

However, depending on your financial needs, your business may have additional ledgers that focus on one aspect of your business. For example, a purchase ledger may solely track any purchase your company makes and any subsequent money that is owed for those purchases.

Bank Account Reconciliation

Bookkeeping involves balancing your company’s books with bank records, as well as assisting with cash flow by maintaining the record of money flowing in and out of your company. It’s a tool used to double-check your bookkeeping to ensure all of your records agree with one another.

Bank accounts are typically very reliable. If your business accounts don’t align with your bank accounts, you must discover why. Bank reconciliation allows you to find and fix any errors, catch potential fraud, better track your profitability and even help you prepare for filing taxes.

Financial Reporting

The best bookkeeping services will create monthly and annual financial reports for your business. These reports should include a balance sheet and income  statement.

statement.

Financial reports are especially important for businesses who want to have a better understanding of their current performance. They also play a critical role in developing future financial projections, which is important if your company has shareholders or investors. If you’re seeking new investors or bank loans, these reports will cover critical financial information that they will typically require before doing business with you.

Accounts Payable and Receivable

Bookkeeping services include maintaining your company’s accounts payable and receivable accounts. This service includes the recording and categorizing of the money that is owed to your vendors and the money that is owed to you by your clients. This type of service includes tracking invoices and monitoring payments.

This process can be very time-consuming, which is why many companies have a designated in-house team to handle this or they outsource to financial professionals who understand the importance of how this part of your accounting system impacts your business.

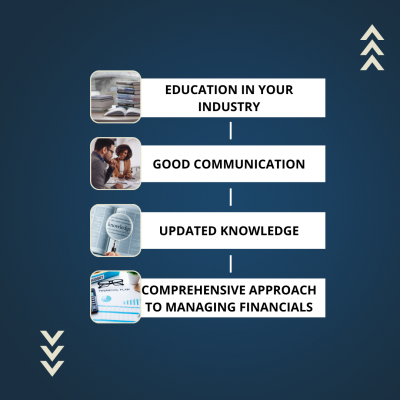

The Top 4 Qualities To Look For In Bookkeeping Services

If you’re searching for bookkeeping services to help manage the financials of your company, here are 4 qualities to look for in the best partners.

1. Education In Your Industry

Accurate accounting is essential to your company’s sustainability. Working with a reputable bookkeeping services company is critical to managing your cash flow, meeting your financial obligations and planning future investments.

The best match for your company will be a bookkeeping service that has professional education in the field and has relevant experience in your industry. In addition to bookkeeping procedures, an experienced firm will be an expert in the various types of accounting software used to maintain your books as well as any tools used to provide you with an accurate financial analysis.

2. Good Communication

Staying on top of your financial health is paramount to good business. It’s important to work with a bookkeeping service that will communicate regularly with you, whether that’s alerting you to potential issues or providing you with routine progress reports that keep you informed and help you make other business decisions.

Every bookkeeping service’s communication style is different, so before you begin a partnership with a company, ensure you have a clear understanding of how often and by what means the company communicates with its clients. If there is a particular communication method you prefer, such as by phone or email, make sure a bookkeeping service can accommodate those requests.

3. Updated Knowledge

The financial industry is constantly changing. New tools are being developed continually to help bookkeepers and financial specialists efficiently monitor clients’ accounts.

Some bookkeepers are guilty of earning the necessary credentials to go into business, but don’t routinely update their knowledge and skills in tools that can help put your company in a better financial position. Many also stay on top of evolving tax regulations, but the best bookkeeping services will also stay ahead of the curve so that they can remain at the forefront of their industry.

4. A Comprehensive Approach To Managing Financials

Companies that offer a comprehensive approach to managing your finances can leave you with the confidence that your accounting and taxes are well taken care of as well. After all, bookkeeping is just one component of your company’s overall financial management.

For example, full accounting services may also include:

- Cash flow management, which ensures you have financial liquidity when required

- Financial ratios, which help analyze the performance of your company compared to other businesses in your industry

- Tax preparation, which includes ensuring your business is in compliance with tax laws and industry regulations, as well as ensuring you are maximizing your tax deductions and credits to help you save money and preserve your wealth

A comprehensive accounting and bookkeeping service will also utilize strategic planning, which is more important than ever in today’s changing business climate. While bookkeeping services deal with the X’s and O’s of your company’s finances, it’s also important to understand why your firm exists and where it’s headed in the future. Strategic planning offers a strong foundation for growth and puts your business on a path toward sustainability.